Learn how to trade Rising and Falling Wedge patterns in forex. Discover key elements, breakout strategies, and risk management for profitable trades.

In the forex market, chart patterns are critical for technical analysis and identifying potential trade setups. Among the most popular and effective chart patterns are the Wedge patterns, specifically Rising Wedges and Falling Wedges. These patterns signal potential reversals and continuations in price trends, making them invaluable for traders seeking to capitalize on trend shifts. In this guide, we’ll explore what Rising and Falling Wedge patterns are, how to identify them, and the key premises for using them effectively in forex trading.

What is a Wedge Pattern?

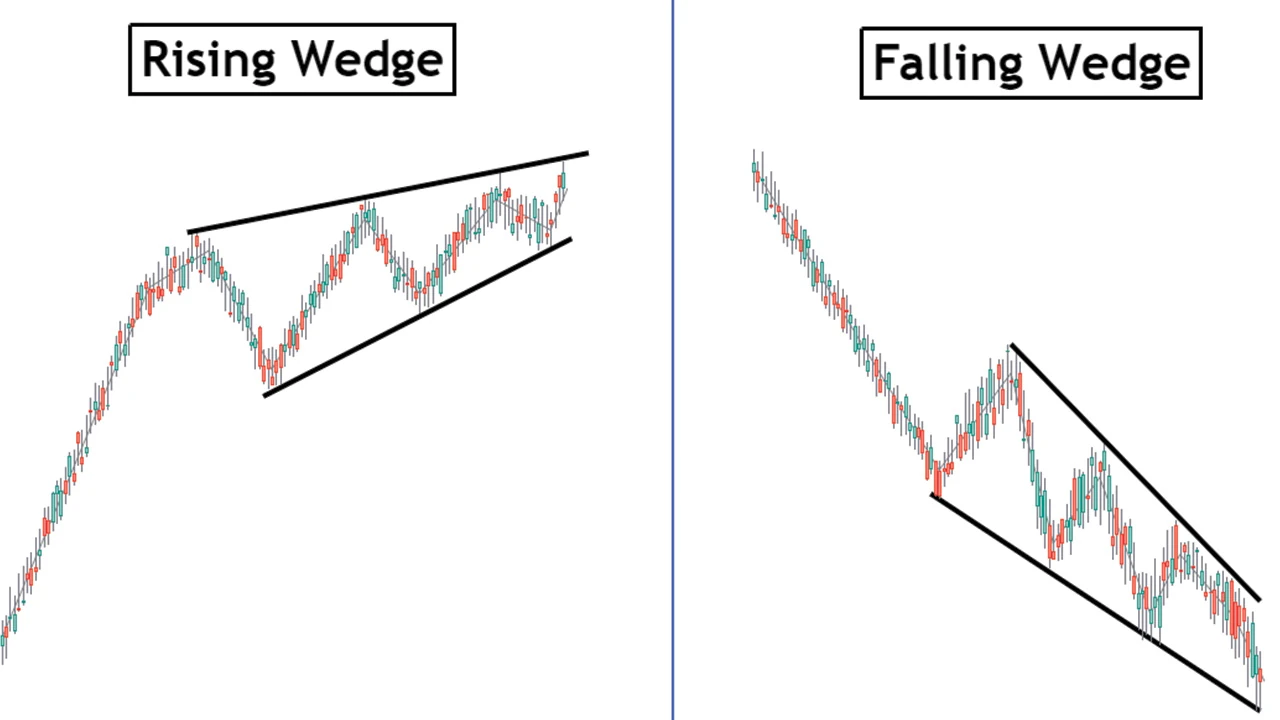

A Wedge pattern is a technical analysis chart pattern that is formed by two converging trendlines. These trendlines slope either upwards or downwards and represent price movement that is narrowing over time. The slope of the price movement, along with the convergence of the trendlines, creates a "wedge" shape.

The wedge pattern can signal either a reversal or a continuation of the existing trend, depending on the direction of the wedge and whether it is rising or falling.

Two Types of Wedge Patterns:

Rising Wedge: A Rising Wedge forms when the price is moving higher but the upward momentum is weakening. It is characterized by a narrowing price range with both support and resistance lines sloping upwards. This pattern typically signals a bearish reversal, as the price is expected to break down from the support line after the pattern completes.

Falling Wedge: A Falling Wedge occurs when the price is falling, but the downward momentum is slowing. The pattern is formed by converging downward-sloping trendlines. A Falling Wedge usually indicates a bullish reversal, as the price is likely to break out to the upside once the pattern completes.

Key Characteristics of the Rising and Falling Wedge Patterns

Converging Trendlines: The hallmark of a Wedge pattern is the convergence of two trendlines—support and resistance. As the price action progresses, the gap between these trendlines narrows, forming the wedge shape.

Price Compression: During the formation of a wedge, the price begins to "compress," with higher lows in a Falling Wedge and lower highs in a Rising Wedge. This price compression suggests that market momentum is weakening and a breakout is imminent.

Breakout Direction: A Rising Wedge typically breaks to the downside, signaling a bearish reversal, while a Falling Wedge tends to break to the upside, indicating a bullish reversal.

Volume Confirmation: Volume often declines as the wedge pattern forms, signaling waning interest in the current trend. A surge in volume during the breakout can confirm the validity of the pattern.

Trading the Rising Wedge in Forex

The Rising Wedge pattern is generally a bearish reversal signal, especially when it occurs after an extended uptrend. The pattern suggests that while the price is moving upward, the momentum is weakening, and a breakdown is likely.

How to Identify a Rising Wedge

Upward Sloping Trendlines: The Rising Wedge is characterized by both support and resistance lines sloping upwards. The resistance line marks the highs, and the support line connects the higher lows, but the rate of price increase starts to slow as the lines converge.

Volume Decline: As the price moves within the wedge, trading volume often decreases, indicating that buyers are losing momentum.

Breakout Point: The Rising Wedge is confirmed when the price breaks below the lower trendline (support) with increased volume, signaling the start of a bearish reversal.

Trading the Rising Wedge: Strategy and Risk Management

Entry Point: Enter a short position when the price breaks below the support trendline, confirming the bearish breakout.

Stop Loss: Place a stop-loss order just above the last swing high within the wedge to protect against a false breakout.

Take Profit: Measure the height of the wedge at its widest point and project that distance downward from the breakout point to set a profit target. This provides a reasonable estimate of how far the price might fall after the breakout.

Volume Confirmation: Ensure that the breakout is accompanied by an increase in volume. This adds credibility to the bearish signal.

Trading the Falling Wedge in Forex

The Falling Wedge is a bullish reversal pattern, indicating that while the price is declining, the selling momentum is weakening. The pattern suggests that a bullish breakout is likely, signaling the end of the downtrend.

How to Identify a Falling Wedge

Downward Sloping Trendlines: A Falling Wedge is identified by two downward-sloping trendlines. The upper trendline marks the lower highs, and the lower trendline connects the lower lows, but the rate of decline starts to slow as the lines converge.

Volume Decline: Similar to the Rising Wedge, volume typically decreases as the price consolidates within the Falling Wedge, signaling weakening seller pressure.

Breakout Point: The Falling Wedge is confirmed when the price breaks above the upper trendline (resistance) with increased volume, indicating the start of a bullish reversal.

Trading the Falling Wedge: Strategy and Risk Management

Entry Point: Enter a long position when the price breaks above the resistance trendline, confirming the bullish breakout.

Stop Loss: Place a stop-loss order just below the last swing low within the wedge to manage risk in case of a false breakout.

Take Profit: Measure the height of the wedge at its widest point and project that distance upward from the breakout point to set a profit target.

Volume Confirmation: Look for a spike in trading volume during the breakout to confirm the validity of the bullish reversal.

Key Premises for Using Wedge Patterns in Forex

To successfully trade Rising and Falling Wedge patterns in the forex market, there are several important premises to understand:

1. Trend Context is Crucial

Wedge patterns are typically reversal signals, but they can also act as continuation patterns in certain contexts. It’s essential to analyze the prevailing trend before the wedge forms. In an uptrend, a Rising Wedge signals a potential reversal, while in a downtrend, a Falling Wedge hints at an impending bullish breakout.

2. Volume is a Key Indicator

Volume plays a critical role in validating Wedge breakouts. During the formation of the wedge, volume should decline, reflecting weakening momentum. However, when the breakout occurs, there should be a significant increase in volume, confirming the price action and the validity of the breakout.

3. Timeframe Matters

Wedge patterns can appear on various timeframes, but they tend to be more reliable on higher timeframes (such as the 4-hour or daily charts). Trading on lower timeframes can lead to false signals, as short-term price action may create temporary wedges that don’t result in significant breakouts.

4. Risk Management is Essential

As with any trading strategy, risk management is key when trading wedge patterns. Always use stop-loss orders to protect your trades in case of false breakouts or sudden market reversals. Proper position sizing based on risk tolerance is also crucial to minimize potential losses.

5. Combine with Other Indicators

While wedge patterns are powerful on their own, combining them with other technical indicators—such as moving averages, RSI, or MACD—can enhance the accuracy of your trade entries and exits. These indicators help confirm the strength of the trend or the likelihood of a reversal, providing additional support for your analysis.

Common Mistakes When Trading Wedges

While the Rising and Falling Wedge patterns are reliable indicators, traders often make common mistakes that reduce their effectiveness:

Entering Too Early: Entering a trade before the wedge breakout is confirmed can lead to false signals.

Ignoring Volume: Failing to confirm the breakout with volume can result in entering weak or false breakouts.

Overlooking Risk Management: Not using stop-loss orders or proper position sizing can expose traders to unnecessary risks.

Conclusion

The Rising Wedge and Falling Wedge patterns are powerful tools in forex trading, offering traders valuable insights into potential trend reversals. These patterns, when properly identified and traded with volume confirmation and disciplined risk management, can lead to highly profitable trades. By understanding the key premises behind these patterns and applying them in the right market conditions, traders can improve their success rates and make more informed decisions in the forex market.

Published by:

![]() Daniel Carter

Daniel Carter